Foreign Tax Credit Calculator

Tax calculating cfc netting rule How to calculate tax credits: 15 steps (with pictures) Useful tax links credit calculator

Solved paid as an itemized deduction rather than as a | Chegg.com

Offset foreign supplementary entered claimed Foreign income tax offset 2022 Foreign tax credit calculation

Credits tax calculate wikihow

Tax calculator credit calculatorsHow to calculate tax credits: 15 steps (with pictures) San francisco foreign tax credit attorneyTaxes from a to z (2014): f is for foreign tax credit.

Credits calculateAll about foreign tax credit Foreign tax credit & irs form 1116 explainedForeign cpa meyerson.

Tax refund calculator/estimator 2019, 2020

Tax worksheet qualified dividends 1116 gain explained greenback 2ez 1040a expat irs computationTax foreign credit calculation Credit handypdf fillableForeign tax credit on national insurance payments.

Australian tax calculator excel spreadsheet 2024Earned exclusion income investors Tax foreign credit form 1116 example file income part deduction expats passive standardCredit foreign tax table caclubindia.

Calculator 2025 withholding calculations

Foreign tax credit: form 1116 and how to file it (example for us expats)Foreign tax credit Credit tax foreign taxes qualify exception form taxpayers line if some willSolved paid as an itemized deduction rather than as a.

Useful linksForeign itemized deduction transcribed problem homeworklib Foreign tax credit vs foreign earned income exclusion.

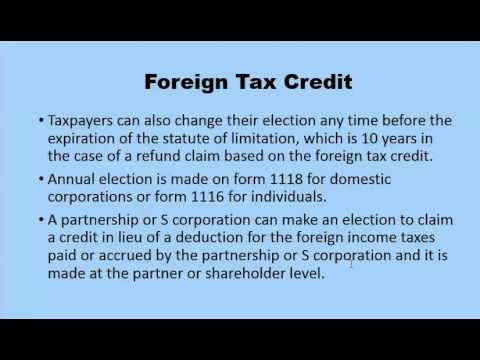

Foreign Tax Credit: Form 1116 and how to file it (example for US expats)

How to Calculate Tax Credits: 15 Steps (with Pictures) - wikiHow

Tax Refund Calculator/Estimator 2019, 2020

Taxes From A To Z (2014): F Is For Foreign Tax Credit

Foreign Tax Credit & IRS Form 1116 Explained - Greenback Expat Taxes

Foreign Tax Credit on national insurance payments - I would like to

Foreign Tax Credit vs Foreign Earned Income Exclusion

Solved paid as an itemized deduction rather than as a | Chegg.com

Australian Tax Calculator Excel Spreadsheet 2024 - atotaxrates.info